Work Collection

OkPayments

Overview

OkCredit Payments was designed to simplify digital transactions for small merchants, helping them collect and send payments effortlessly while reducing manual reconciliation. The goal was to provide a seamless, reliable, and transparent payment experience, fully integrated with their existing bookkeeping workflows.

With our system, merchants saved time, improved cash flow, and embraced digital transactions more effectively, reducing dependency on cash and manual record-keeping. 🚀

Key Capabilities

✅ Receiving Payments

Payment Link, Physical QR, In-app QR, WhatsApp Payment Reminder

✅ Sending Payments

Scan & Pay and In-App Payment

✅ Scheduled Payments

QR Payments

What We Observed

📝Merchants manually logged transactions, often uploading screenshots of payment instead of using our QR, payment link and reminders

📌 60-70% of transactions were added during weekday business hours, indicating that merchants used the app while working so collecting payment at time of sale

❌ Many didn’t realize QR codes & payment links could auto-reconcile payments, reducing manual work

Problem Statement

How can we drive higher adoption of digital payments among merchants already accepting online payments, increasing both transaction volume and unique users?

Solution

✅ Integrated QR codes and payment link shortcuts into high-usage flows like “Add Payment” to encourage effortless digital collections.

✅ Introduced educational nudges to highlight the benefits of auto-reconciliation, helping merchants reduce manual work.

Impact

🚀 Increased digital payment adoption by 2%, aligning with merchant behavior.

⏳ Saved merchants valuable time by automating payment reconciliation.

📱 The improved flow was successfully adopted and is now live in the current app version.

Payment Reminder

What We Observed

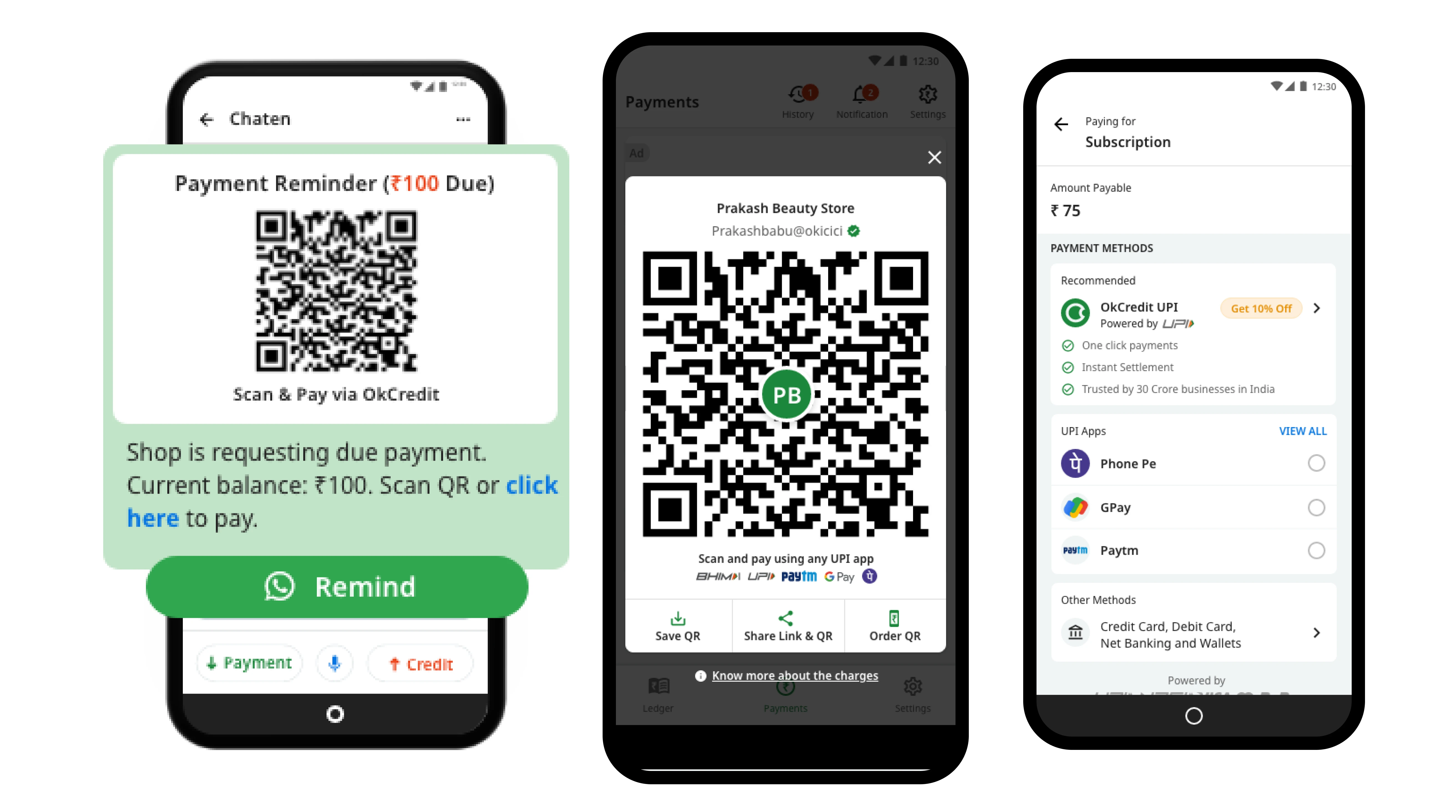

📌 Customers with long-overdues often missed or ignored reminders

📌 WhatsApp reminders with QR codes and payment links had low adoption.

📌 Generic messages lacked urgency and personalization, delaying payments

Problem Statement

How can we improve the adoption of payment reminders and accelerate digital debt recovery for merchants?

Solution

💰 Incentives: Introduced cashback & discounts to encourage timely payments.

📩 Personalized Reminders: Custom themes & due-day-based messages to drive urgency.

🔔 Localized Notifications: WhatsApp & push alerts with engaging, tone-optimized messaging (strict, friendly, casual)

Impact

✅ Higher adoption of reminders through cashback incentives.

✅ Faster repayments with urgency-driven, personalized messaging.

✅ More online payments, reducing manual collection efforts & improving ledger accuracy.

Schedule Payments

What We Observed

📌 Merchants frequently uploaded images of post-dated cheques as proof of payment

📌 Retailers often lacked sufficient balance when cheques were due, causing bounced payments and strained supplier relationships

📌 There was no automated way to ensure timely payments or notify retailers in advance

Problem Statement

How can we automate payments and reduce the risks of bounced cheques to improve trust and reliability in business transactions?

Solution

💳 Scheduled Payments: Enabled suppliers to set up automatic debits via payment mandates.

🔔 Pre/Post-Payment Alerts: Retailers received notifications, ensuring transparency.

🚫 Supplier Controls: Allowed suppliers to ban unreliable retailers for accountability.

Impact

✅ Scaled successfully across loans & subscriptions.

✅ Improved cash flow & security by eliminating reliance on post-dated cheques. 🚀

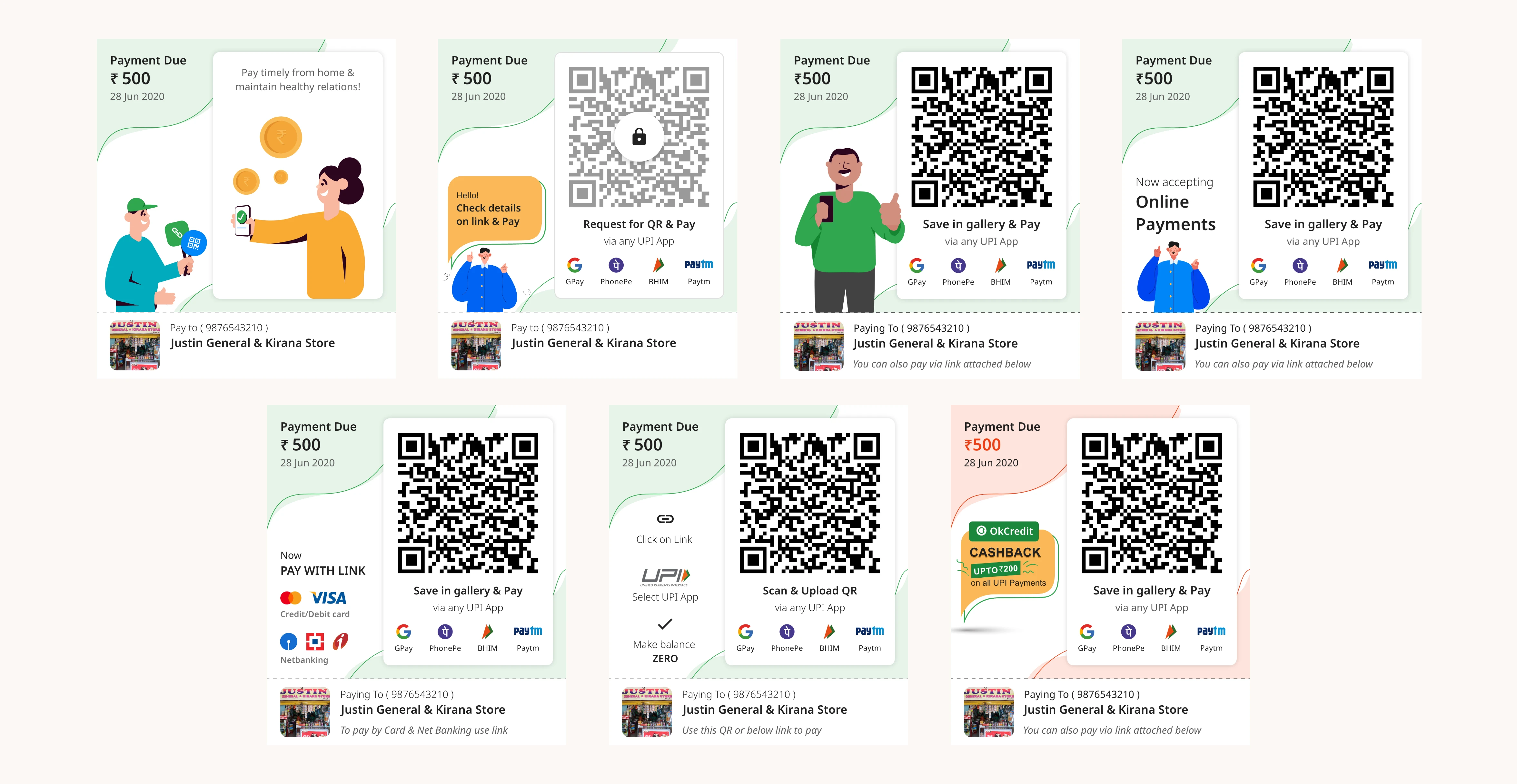

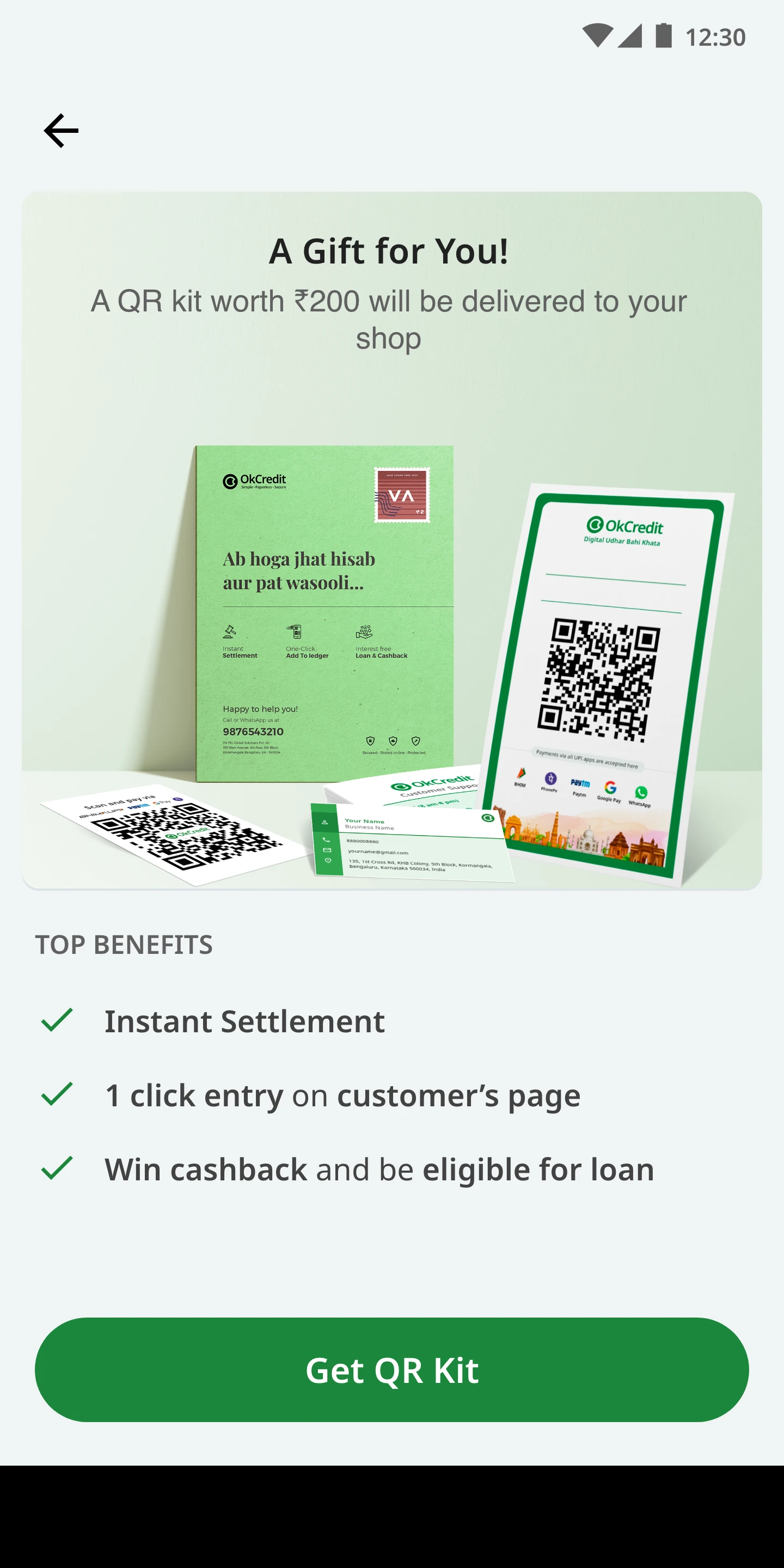

Order QR

Problem Statement

How can we drive higher adoption of QR payments among merchants by making them more accessible and visible?

Solution

🏪 Physical QR Campaign: Launched region-specific QR designs tailored for merchants.

📦 QR Package Included:

QR stickers for storefronts & counters.

Phone stickers for easy mobile access.

Standees for checkout visibility.

Welcome card with setup instructions.

Impact

✅ Increased QR adoption by enhancing visibility and accessibility.

✅ Gathered key insights on merchant behavior for future solutions.

✅ Validated demand for physical payment tools, shaping future strategies.

🚀 Limited Rollout: Piloted with a select audience but discontinued due to costs and the rise of alternatives like soundboxes.

What We Observed

📌 Merchants relied on manual cash collection, sending staff with handwritten lists.

📌 The process was slow, error-prone, and lacked real-time tracking, leading to reconciliation issues.

📌 Merchants had to manually tally payments, making it hard to track who had paid.

Problem Statement

How can we streamline cash collection, reduce errors, and enable real-time tracking for merchants?

Solution

💡 Digital Collection System allowing merchants to

Create and share a digital collection list with staff

Provide clear payment details for seamless collection

Accept payments via UPI, card, cash, or net banking

Instantly record transactions, updating the ledger in real-time

Impact

✅ Eliminated manual tracking, reducing errors and effort, Saved time, Increased efficiency

✅ Scaled successfully into a distributor-focused collection product

Collection List

In-App Payment

What We Observed

📌 Merchants needed a faster, seamless way to pay suppliers and manage business payments.

📌 Existing payment methods lacked integration within the OkCredit app, adding friction to transactions.

Problem Statement

How can we enable quick, seamless digital payments within OkCredit for supplier transactions and other business needs?

Solution

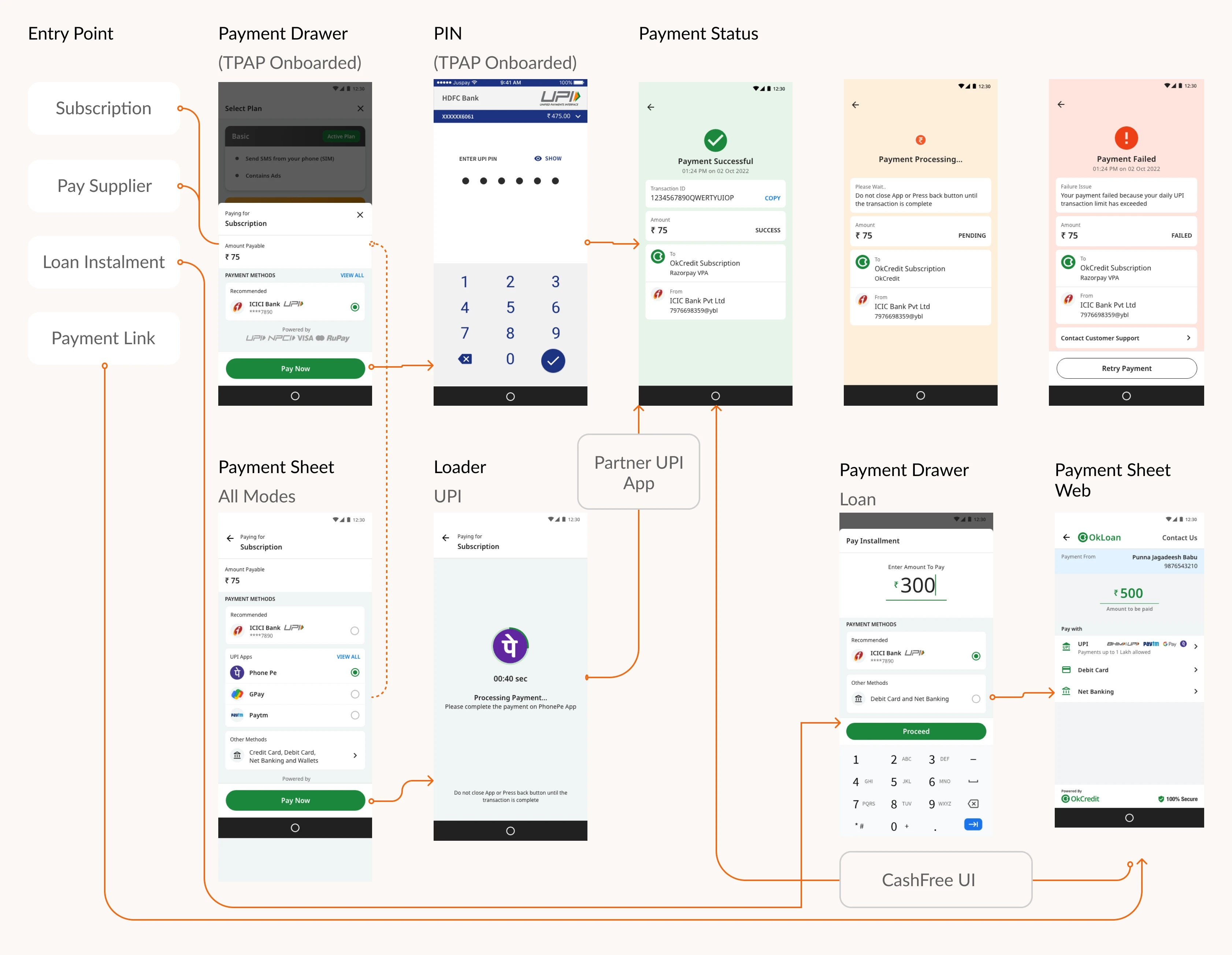

💡 Launched UPI Payments with a TPAP license, allowing merchants to:

Pay suppliers directly from the OkCredit app.

Use UPI for subscription purchases and OkLoan repayments.

Enjoy a frictionless, integrated payment experience.

Impact

✅ Simplified business payments, reducing reliance on external apps.

✅ Scaled beyond supplier payments to loans & subscriptions.

✅ Enabled faster, more efficient transactions within OkCredit. 🚀